1 — Introduction

When goods are imported into the United States, the importer-of-record (IOR) must, with reasonable care, file an entry (CBP Form 3461) and entry summary (CBP Form 7501), or the electronic equivalents, with U.S. Customs and Border Protection (CBP). These documents are the IOR’s preliminary and final declarations about the nature and circumstances of the import transaction, and they tell the story of the transaction through more than forty data elements. Of these data elements, the classification of the goods under the Harmonized Tariff Schedule of the United States (HTSUS, or HTS) is perhaps the most critical element because it serves multiple purposes that fall into three broad buckets: admissibility, statistical reporting, and revenue collection. We will look at each of these buckets in more detail, and then we will review the different methodologies for calculating duties in support of revenue collection.

2 — The Three Primary Purposes of the HTSUS

2.1 — Admissibility

HTS classification provides CBP and other governmental agencies (OGAs) with a mechanism for determining the admissibility of an imported article.

Entry into the “commerce” of the United States is not guaranteed simply because a shipment of widgets arrives in a U.S. port from a foreign country. Just as a person entering the U.S. must present a passport (and perhaps a visa) to establish eligibility to enter or reenter the country, an importer must similarly present evidence (the 3461 and 7501, commercial invoice, bill of lading, packing list, compliant origin marking, perhaps a sample, etc.) that persuades CBP or another agency of an article’s fitness for admission into our commerce. Most goods from most countries can legally enter the U.S. as long as the IOR files an acceptable 3461 and 7501; pays the appropriate estimated duties,[1] taxes and fees; and complies with all admissibility requirements applicable to the imported goods. The bar for admission is, in fact, set reasonably low, as relatively few shipments are denied entry. But there are many classes of goods that are either prohibited—such as certain goods from embargoed countries, counterfeit goods, or archeological artifacts obtained illegally—or that are restricted to some extent by CBP or other government agencies. Those goods that are in some way restricted under an OGA’s rules typically must be classified under the appropriate HTS classifications to understand the extent of the restriction.

There are many examples of OGA entry requirements, and the common thread among many of these requirements is that they are all triggered primarily by the HTS classification assigned to the imported product. For instance, automobiles, radio frequency devices, and food are three examples of products subject to specific OGA requirements linked to the HTS classification. The classification of an automobile in Chapter 87 of the HTS will trigger specific safety and environmental requirements. If the importer fails to satisfy these non-tariff requirements, the automobile will be denied entry into the United States. Pharmaceuticals and food, as well as drug- and food-related articles and equipment scattered throughout several chapters of the HTS, are subject to the requirements of the FDA (Food & Drug Administration). Similarly, certain radio frequency devices found in several chapters (84, 85 and 90) must meet FCC (Federal Communications Commission) requirements to enter the country. Hence a shipment of computer keyboards under HTS 8471.60.20 will automatically be flagged for FCC compliance.[2] Flagging by HTS classification alerts CBP, the importer, and the customs broker that an OGA requirement must be satisfied before the shipment will be released.

Admissibility is not solely determined by the HTS classification; it is also impacted by a range of enforcement requirements unrelated to the HTS, including national security, intellectual property rights (such as trademark, copyright, or patent infringement), protection of cultural heritage, trade embargoes, public safety, or, most recently, forced labor prevention. CBP will look at all the data known about a shipment—the HTS classification being a primary data point—to help them (and other agencies, as appropriate) target for interdiction and inspection shipments of, say, potentially counterfeit toys, unapproved pharmaceuticals, gray-market toothpaste, illicit archeological artifacts or works of art, or goods that may pose a physical threat to American citizens, property, environment, or infrastructure.[3] All told, CBP enforces the import-related laws and regulations of more than forty federal agencies.

Classification also affects the admissibility of products that are subject to import quotas. There are many examples of goods subject to quotas, such as dairy products found in Chapter 4, tuna in Chapter 16, or olives in Chapter 20. Quotas may be administered in two ways: as an absolute quota or as a tariff rate quota (TRQ).[4] Under an absolute quota (also known as a “quantitative” quota), CBP publishes an annual predetermined ceiling on the import volume of a product, and these ceilings are typically set on a country-specific basis. Once that pre-determined ceiling of import volume is reached (aggregated using data from all ports of entry), no further imports of the commodity are allowed until the quota window re-opens. Under a TRQ, a published duty rate is in effect until the quota level (also based on aggregated data) has been reached; any subsequent imports of the same commodity are assessed a higher rate of duty for the remainder of the quota period.[5] A third type of import restraint system that is administered in a manner similar to quotas is known as a “tariff preference level” (TPL) established under a free trade agreement (as existed, for example, under NAFTA and now under USMCA) or another special trade program.[6] Under a TPL, a reduced duty rate is offered to certain goods (such as textiles and apparel) if the established import quantity threshold has not yet been reached.

Yet another nexus between HTS classification and admissibility was created under the Importer Security Filing (ISF) program implemented by CBP in 2009 for all shipments arriving by vessel. The HTS classification of each product is one of the mandatory “10+2” data elements transmitted to CBP before the foreign loading of a U.S.-bound vessel.[7]

2.2 — Statistical Reporting

HTS classification facilitates the collection of trade statistics on both import and export transactions.

HTS statistics allow industries, economic analysts, various governmental agencies (primarily the U.S. Census Bureau), and non-governmental agencies to better understand, for example, broad trends in trade activities or a narrower range of activities associated with a specific country, industry sector, port of entry, product, or type of activity. When we read a report about last month’s balance of trade figures for, say, the automotive industry, we should remember that the HTSUS played a crucial role in the collection of this trade data. As well, because the Harmonized System (upon which the HTS is based) is a globally adopted common nomenclature, it is now easier to evaluate trade activity with greater precision and consistency from a global perspective rather than simply an insular national perspective. Thanks to the HS, the gathering and meaningful analysis of trade statistics has become a relatively simple matter.

2.3 — Revenue Collection

HTS classification enables CBP to assess and collect import duties and taxes for revenue purposes on a broad range of differentiated goods.

CBP’s primary mission for most of its history was to “protect the revenue” of the United States, and the significance of this revenue function was underscored by the fact that CBP resided under the Department of Treasury from 1789 until 2002. In fact, until 1913 when the government’s right to impose a federal income tax became embedded in the Constitution as the Sixteenth Amendment, the federal government’s primary source of revenue was import tariffs. But this revenue-based mission was radically reinvented in 2002 when the Department of Homeland Security was created and assumed responsibility for transitioning the “old” U.S. Customs Service into the “new” agency called U.S. Customs and Border Protection. Despite CBP’s new high-profile emphasis on border and port security, revenue protection continues to be a prime mandate for the reconfigured agency.

Each tariff provision in the HTS is associated with duty rates found in three columns: “Column 1–General” (applicable to most imports), “Column 1–Special” (applicable when an import is eligible for preferential treatment under a special trade program such as a free trade agreement) and “Column 2” (applicable against imports originating in certain unfriendly countries). Duty rates can range from “free” (meaning that no duty is assessed) to a significant percentage of an imported article’s value (such as a Column 1–General rate of 350% for some tobacco). In addition to the rates of duty associated with every tariff provision, some provisions may trigger the assessment of non-tariff taxes (such as Internal Revenue taxes on liquor or tobacco products, or Department of Agriculture “assessment fees” on products such as beef, pork, honey, and potatoes); antidumping duties (assessed against products as diverse as tomatoes and ball bearings) and countervailing duties (such as those famously assessed against subsidized imports of Canadian softwood lumber);[8] or special protective duties under Sections 201, 232, and 301.[9]

3 — Duty Rate Methods

Although the United States has used several tariff nomenclatures throughout its history (including the HTSUS and its immediate predecessor, the Tariff Schedules of the United States (or TSUS)), one common thread woven into each system has been the methods used to calculate duties. There have always been only two “pure” ways to compute duties in the HTSUS, which are the ad valorem or the specific methods. But there are also several methods that are hybrids of the ad valorem and specific methods—namely, the compound, complex, technical, and borrowed methods.

To understand how the HTS facilitates the administration of duty rates, we must look at how HTS provisions are structured. An HTSUS provision is, for practical purposes, a ten-digit number.[10] The first column in the HTS shows the headings and the subheadings to the eight-digit level, which is the level at which duty rates are assigned.[11] The second column shows the last two digits, which are officially known as the “statistical suffix” and hence have no effect on duty assessment.

3.1 — Ad valorem Duty Rate Method

A duty rate expressed as a percentage of the dutiable value is an ad valorem rate. For example, a felt-tipped pen classified under 9608.20.00 is dutiable at 4.0% under “Column 1–General”. This means duty of $4.00 would be assessed on an import of felt-tipped pens valued at $100 (assuming $100 represents the entered value, meaning that upward or downward adjustment of the selling price wasn’t required because of assists, commissions, discounts, royalties, freight, etc.). An ad valorem rate must always be multiplied by an entered value in U.S. dollars rounded to the nearest whole dollar, thus an invoice price in a foreign currency must be converted to dollars based on either a proclaimed or certified conversion rate before the entered value is determined.[12]

The ad valorem methodology has been used for centuries by customs authorities around the world because of its simplicity. Ad valorem rates predominate throughout the HTSUS—indeed, they comprise roughly 83% of all dutiable 8-digit tariff lines in 2022—although this wasn’t always the case.[13] Historically, the use of ad valorem rates has been criticized as an open invitation for fraud. While skepticism about the government’s ability to detect dishonest importers may have been reasonable a century ago, the risk of widespread valuation fraud has diminished over the years to the point where the ad valorem methodology is, as noted above, the preferred method, both in the U.S. and elsewhere. Several factors have contributed to this confidence in value-based tariff rates. In an integrated global economy with common accounting, banking, and corporate governance laws, practices, and standards, and where financial data is readily verifiable through electronic records rather than hand-written ledgers, it’s much easier for a customs agency to target, investigate, and successfully prosecute valuation fraud. Other important factors include the almost universal adoption of the GATT Valuation Agreement as the common valuation model, and, to a lesser degree, the more consistent and informed use of Incoterms®, which aren’t explicitly codified in federal law or regulation but which nonetheless are a useful aid when determining whether certain contractual costs ought to be included in the entered value of an import.

Ad valorem methodology is exclusively used when assessing antidumping and countervailing duties, and special protective duties under Sections 201, 232, and 301. The Merchandise Processing Fee (MPF) and the Harbor Maintenance Fee (HMF) are also calculated on an ad valorem basis.[14]

3.2 — Specific Duty Rate Method

When duty assessment is based on a designated unit of quantity rather than the entered value, then we have a specific duty rate. Each HTS provision tied to a specific rate stipulates the unit of quantity that must be used in the duty calculation. For example, some goods are dutiable by weight (e.g., shelled pistachios by kilograms (kg) or sugar beets by metric ton (t)), while some may be dutiable by volume (e.g., fresh grapes by cubic meters (m³)) or another unit of measure. Like ad valorem methodology, specific rates aren’t a U.S. invention, as they also have been in widespread use dating back many centuries. It’s been argued, though, that specific duty rates are inherently inferior to ad valorem rates as a means of providing both equitable protection and maximum revenue. This is because specific rates, by definition, place an inequitable tariff burden on the less valuable—and hence, lower quality—grades of a given commodity. An example is fresh beef half-carcasses that are dutiable, regardless of cut or quality, at 4.4¢|kg under 0201.10.05. A shipment of 500 kilograms of lesser-quality (perhaps grain-fed) beef half-carcasses valued at $3,000 would be charged the same duty as a shipment of 500 kilograms of premium-quality (grass-fed) beef half-carcasses valued at $6,000, which means that the cost to import the lesser-grade beef is, as a percentage of the invoice value, essentially double the cost to import the better beef. Conversion of a specific rate into an ad valorem rate, which is often an insightful if not necessary calculation, is accomplished by a method called “Ad Valorem Equivalent (AVE)”.[15] Another characteristic of specific duty rates is their resistance to price adjustments or currency fluctuations, which can be either a good or bad thing depending on the perspectives of the buyer and seller.

Specific rates are commonly linked to bulk commodities sold by weight or volume—products like foods, minerals, lumber or chemicals, for instance—rather than finished goods, but this is a general observation rather than a rule, as many finished goods do indeed carry specific rates. Specific rates are relatively more prevalent in the first four sections of the HTS than in the remaining sections. Both specific and ad valorem provisions can sometimes be structured according to a value-based segregation of a product. Above a certain unit value, the rate is x; at or below a certain value, the rate is y.

Current examples of products with specific duty rates are:

| Fishing reels | 9507.30.40 | 24¢ each |

| Bamboo clothespins (spring-type) | 4421.91.80 | 6.5¢ per gross |

| Broomcorn | 1404.90.20 | $4.95 per ton |

| Pork sausages | 1601.00.20 | 0.8¢ per kg |

Sometimes the commercial unit of quantity associated with a product will differ from the unit of quantity required by the HTSUS. Often a simple conversion to the metric system is required. Using the example shown above for pork sausages, an importer’s established practice may be to invoice the sausages per pound rather than per kilogram. The importer must convert from pounds to kilograms before the duty can be determined. Or, an importer of recorded magnetic tape classified under duty-free subheading 8523.29.40 may readily know how many linear feet of tape a shipment contains, but for entry purposes the aggregate surface area of the tape’s recording surface must be calculated in square meters (m2).[16]

As noted earlier, the HTS is also used to collect import (and export) statistics, and this statistical data often, but not always, includes a quantitative measurement. Hence, conversion from one unit of quantity to another is often required even though a provision may be unconditionally duty-free (such as our magnetic tape example) or subject to an ad valorem rate. In some cases a tariff provision requires the reporting of two (or more) quantities, such as the kilograms and liters required for naphthalene under subheading 2707.40.00. And sometimes the HTS quantity is unique to a particular product, such as the “fiber m” quantity associated only with fiber optic cables of subheadings 8544.70.00 and 9001.10.00.[17]

In addition to specific rates published in the HTS, certain products, such as alcohol and tobacco, are subject to specific internal revenue (IR) taxes at the time of entry. Further, a range of agricultural products—including livestock, blueberries, and Christmas trees—are subject to import assessment fees at various specific rates.[18]

3.3 — Compound Duty Rate Method

When duty is assessed based on a combination of a specific rate and an ad valorem rate, this is called a compound duty rate (but a compound rate can also be a combination of two specific rates, as in the grape must example below). Compound rates, generally written in the HTS in the format specific + ad valorem, are used relatively infrequently. Some examples are:

| Hedge shears | 8201.60.00 | 1¢ each + 2.8% |

| Pencils | 9609.10.00 | 14¢ per gross + 4.3% |

| Grape must | 2204.30.00 | 4.4¢ per liter + 31.4¢ per pf. liter |

| Fresh mushrooms | 0709.51.01 | 8.8¢ per kg + 20% |

It’s interesting to note that the ad valorem half of a compound rate generally produces the greatest duty assessment. What is the typical price for a pair of hedge shears today? Perhaps a cheap pair costs $10 and a higher-quality pair costs $50. The specific rate remains 1¢ each, regardless of the value.

3.4 — Complex Duty Rate Method

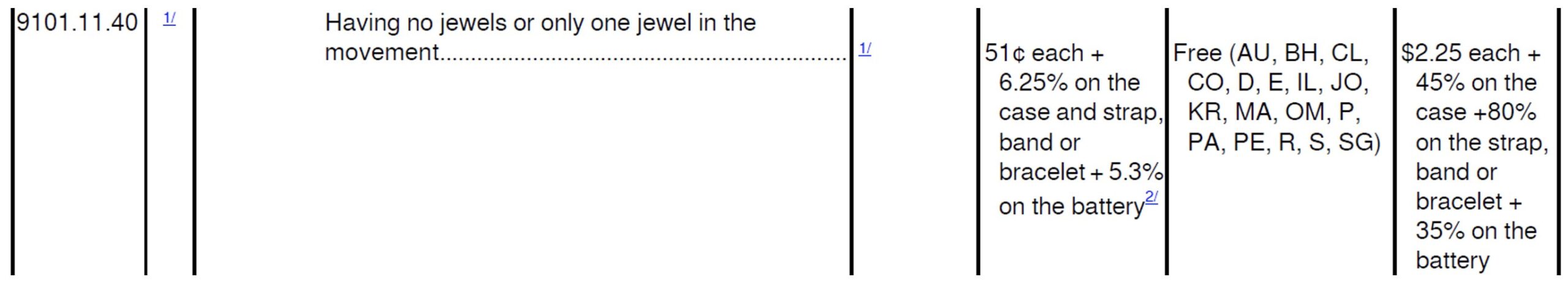

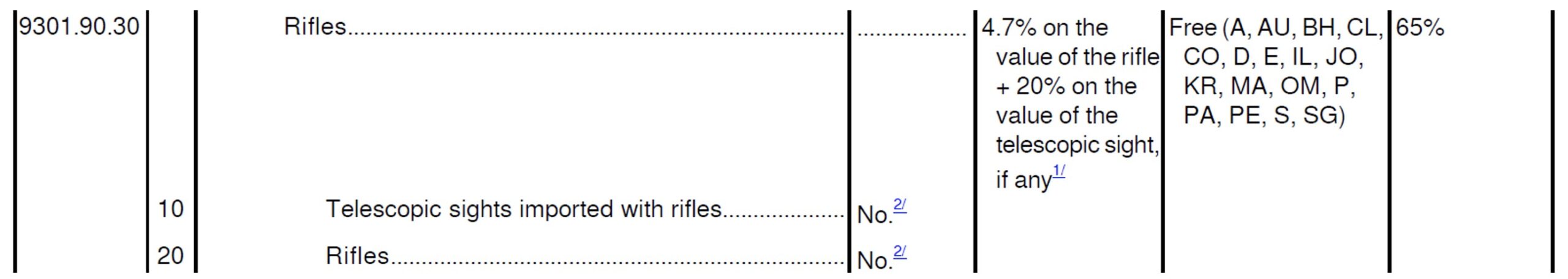

Though relatively rare, sometimes a product must be broken down into its constituent components before the complex duties can be calculated. The complex method assigns different duty rates to different elements of a product. Watches and clocks in Chapter 91 are the prime example of products subject to complex duty rates. We see that certain watches under subheading 9101.11.40 are assessed duty under Column 1–General as follows: 51¢ each; plus 6.25% on the case and the strap, band, or bracelet; plus 5.3% on the battery.

Another example is rifles under subheading 9301.90.30, which assesses ad valorem rates of 4.7% rate on the rifle and a conditional 20% rate on the rifle’s telescopic sight (if any).

Fortunately for the trading community, the use of the complex duty rate method is relatively limited.

3.5 — Borrowed Duty Rate Method

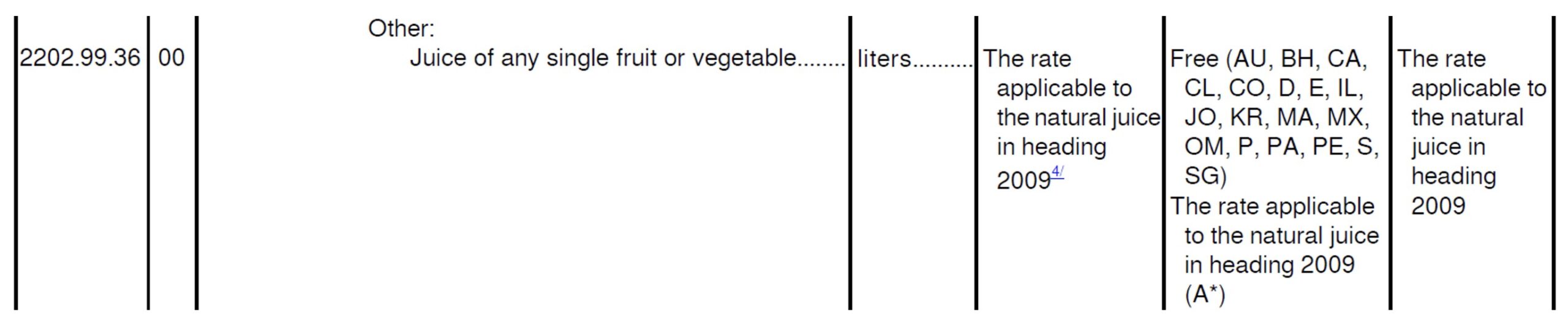

Certain tariff provisions may employ borrowed duty rates. Although the borrowed rate method appears self-explanatory, it is helpful to review a few examples, beginning with certain fruit or vegetable juices under subheading 2202.99.36, which borrows its rate from heading 2009:

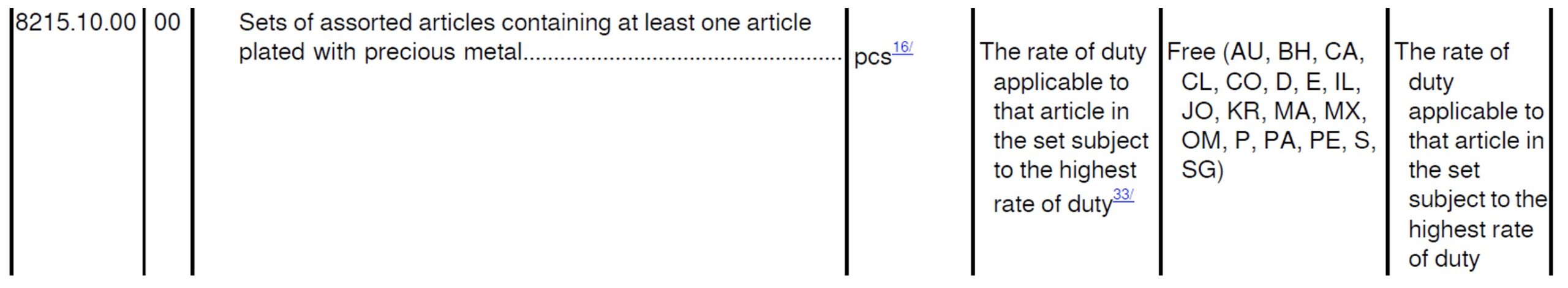

Another example is sets of certain kitchen or tableware articles under subheading 8215.10.00:

To arrive at the applicable duty rate for 8215.10.00, each of the articles in the set must be separately classified to determine which article bears the highest rate of duty. This poses little trouble when the duty rates under consideration are all ad valorem rates, but this becomes a more burdensome effort when comparing an ad valorem rate with a specific or compound rate. When faced with the prospect of comparing a mixture of duty rates, an importer must determine the AVE rate that would provide CBP with the most revenue, and then compare this AVE rate against the highest “straight” ad valorem rate to determine which of the two rates is higher. If it happens that the AVE rate is higher, then the official duty calculation on the entry summary is based on the actual rate (specific or compound) published in the HTS, not the AVE rate.

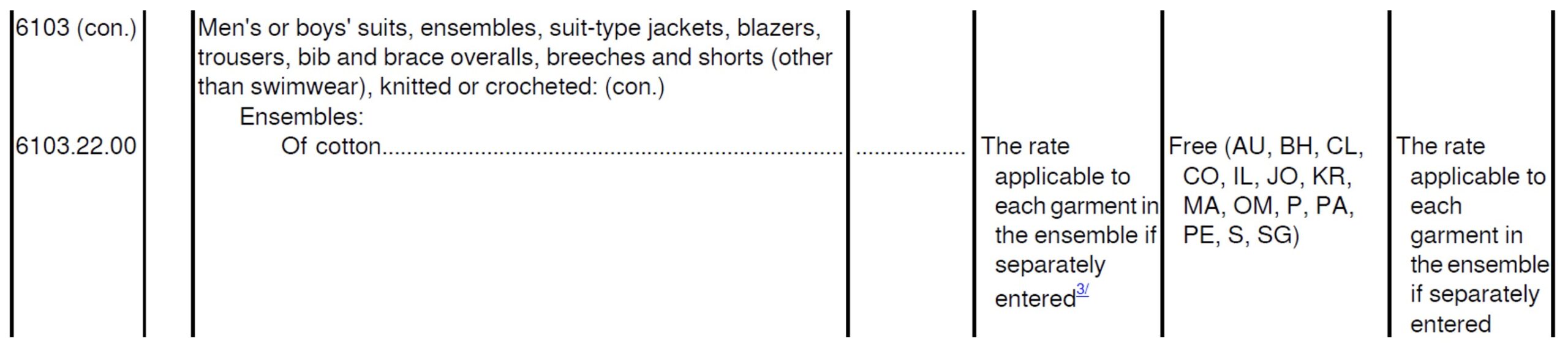

Another example of a borrowed rate (which is also an implicit complex rate) is found in subheading 6103.22.00, which covers certain men’s or boys’ clothing ensembles:

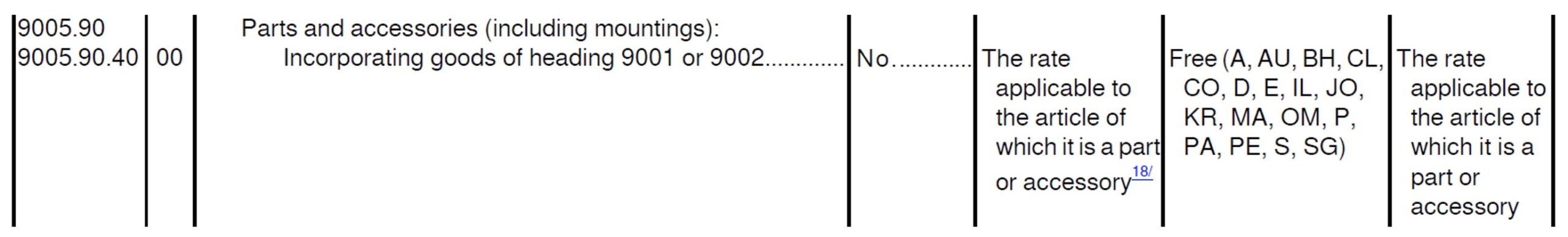

Yet another example is subheading 9005.90.40, which covers certain parts and accessories of optical instruments such as binoculars and telescopes:

3.6 — Technical Duty Rate Method

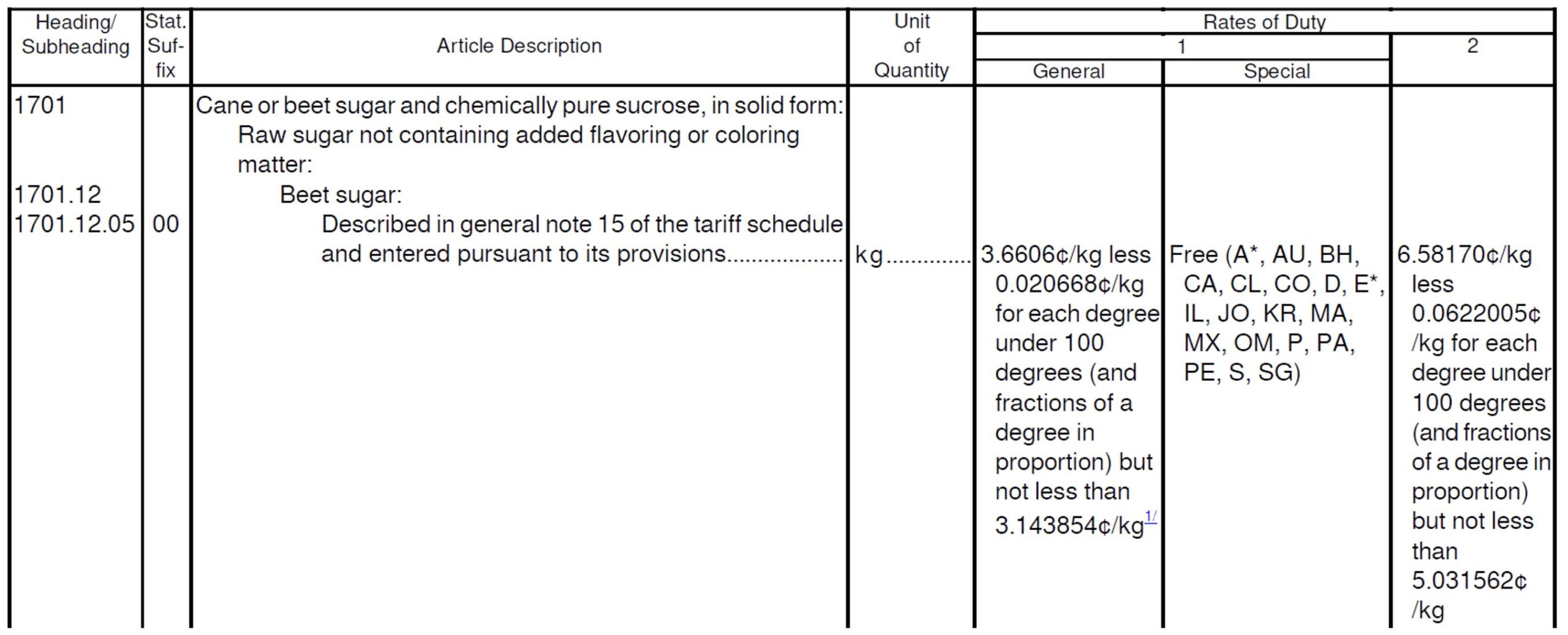

A subset of specific duty rates is known as technical duties, which is so named because certain technical characteristics of an imported product are used to calculate the specific duties. An example of technical specific duties is sugar classified under subheading 1701.12.05:

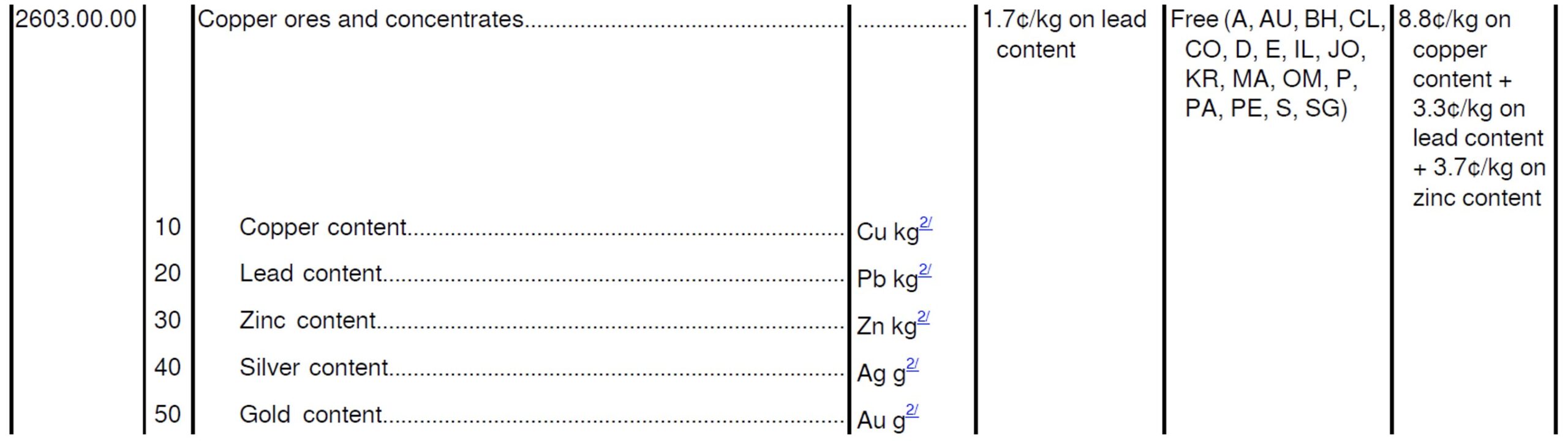

Copper ores under 2603.00.00 are another example:

Note that the Column 1–General rate is based solely on the lead content of the ore, while the Column 2 rate assesses duty based on the copper, lead, and zinc content.

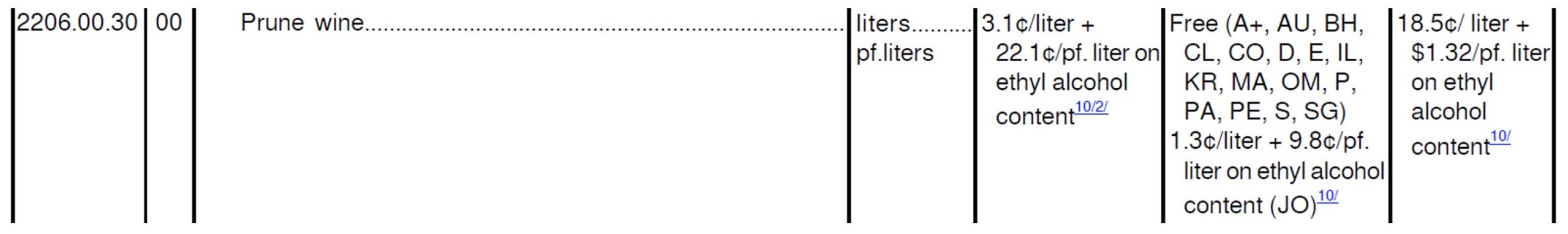

Prune wine under subheading 2206.00.30 is an example of a technical rate but it is also a compound rate comprising two discrete specific rates:

4 — Frequency of Rates

The ITC published breakdowns of the different rate types in the HTSUS for the 11,111 duty-rate lines (8-digit) in 2021, and the 11,414 duty-rate lines in 2022:[19]

|

Column 1 Rate Type |

2021 | 2022 | ||

| Number of Lines | % of Total Lines | Number of Lines | % of Total Lines | |

| Free | 4,197 | 37.8 | 4,315 | 37.8 |

| Ad valorem | 5,698 | 51.3 | 5,864 | 51.4 |

| Specific | 741 | 6.7 | 753 | 6.6 |

| Compound | 318 | 2.8 | 325 | 2.8 |

| Other | 157 | 1.4 | 157 | 1.4 |

5 — Summary

As a critical requirement for every import into the United States, classification of goods under the HTS has demonstrably improved the speed of customs clearances, the effective identification of prohibited or restricted goods, and the accuracy and consistency of customs declarations, duty collections, and trade statistics. Importers are understandably focused on the duty liability associated with their product’s HTS classifications, but they must also give sufficient consideration to the non-tariff risks and responsibilities that HTS classifications may trigger. Hence the multifaceted importance of accuracy and consistency when classifying goods cannot be overstated. Many companies have the expertise and staffing to classify their products with a satisfactory degree of reasonable care, but many do not. If your company falls into the latter category, the attorneys and consultants at Braumiller Law and Braumiller Consulting, who collectively have many decades of HTS classification experience, can help.

[1] The duties paid with the 7501 are called “estimated” duties because the extent of an importer’s duty obligation is not considered final until the entry has been liquidated. The IOR must make a cash deposit or obtain a surety bond that guarantees payment to CBP of all duties determined at liquidation.

[2] Prior to July 1, 2016, an importer of goods subject to FCC requirements had to submit an FCC Form 740, and the goods had to be marked to reflect FCC compliance, but today only the compliance marking is an entry requirement. (Take a look at the underside of your computer’s keyboard and you should find the required FCC authorization. If the keyboard isn’t properly marked you should expect to hear heavily armed men in sunglasses and black suits knocking on your door right … about … now.)

[3] Many of the classes of merchandise that are restricted or prohibited from importation can be found in 19 C.F.R. § 12.

[4] Absolute quotas have fallen from favor as an effective trade restriction measure. In fact, the U.S. currently does not impose absolute quotas against any products.

[5] See, for example, the tuna TRQ for 2022: Tuna Tariff-Rate Quota for Calendar Year 2021 Tuna Classifiable Under Subheading 1604.14.22, Harmonized Tariff Schedule of the United States (HTSUS), 87 Fed. Reg. 35988 (14 June 2022).

[6] Chapter 99 in the HTSUS is used, among other reasons, to administer TPLs.

[7] See 19 C.F.R. § 149. See 73 Fed. Reg. 71730 (Nov. 25, 2008). From its inception in 2008, ISF has been colloquially known as the “10+2” program.

[8] The scope of an antidumping and countervailing order is determined by the language in the order, not by the HTS—but an order will list the affected HTS codes to facilitate effective administration of an import subject to the order.

[9] Sections 201 and 301 of the Trade Act of 1974, and Section 232 of the Trade Expansion Act of 1962.

[10] For those of us old enough to remember, the 1989 through 1992 editions of the HTSUS contained an eleventh “check” digit, a relic from the TSUS. Check digits, which are used to validate the digits that precede them using a mathematic formula, were discontinued with the 1993 edition of the HTS. Another example of check digit usage is found in customs entry numbers. In the current entry number scheme (i.e., nnn-nnnnnnn-n), the first three digits represent the filer code (which identifies the customs broker), the next seven digits are the unique entry number, and the last digit is the check digit. The formula for calculating entry check digits can be found at: https://www.cbp.gov/sites/default/files/documents/app_e_3.doc.

[11] Note that a few headings sprinkled throughout the HTSUS lack subheading language, an anomaly that gives the illusion that the duty rate is assigned at the ten-digit level (two examples are 0205.00.0000 and 9023.00.0000).

[12] See 19 C.F.R. § 159, Subpart C.

[13] More than a century ago, the Tariff Act of 1907 included 444 provisions or “paragraphs”. Ad valorem rates were assigned to only 106 of the paragraphs while specific rates were linked to 246 paragraphs, with the balance of the paragraphs having some form of compound rate. In general, the trend since 1789 has been an increase in the use of ad valorem rates and a decrease in specific rates.

[14] See 19 C.F.R. § 24.23 and 19 C.F.R. § 24.24. Minimum or maximum limits, or other exceptions, may apply.

[15] Presume that a widget is valued at $5. If the specific duty rate on widgets is 50¢ each, then the AVE is 10%. The AVE methodology was explained by CBP in a reconsidered ruling (HQ967248, December 22, 2004). And the USITC decided that chapter 82 needed Additional U.S. Note 3 to address AVE (which is the only note in the HTS that mentions AVE):

For the purposes of determining the rate of duty applicable to sets provided for in heading 8205, 8206, 8211 or 8215, a specific rate of duty or a compound rate of duty for any article in the set shall be converted to its ad valorem equivalent rate, i.e., the ad valorem rate which, when applied to the full value of the article determined in accordance with section 402 of the Tariff Act of 1930, as amended, would provide the same amount of duties as the specific or compound rate.

[16] Since 2017 this has been a duty-free provision; prior to that it was dutiable at 4.8¢|m2.

[17] “Fiber m” is the aggregate length, in meters, of the individual fiber optic strands that make up a fiber optic cable; a ten-meter cable containing three strands has thirty “fiber m”.

[18] See 7 C.F.R. §§1200–1280.

[19] See U.S. International Trade Commission, Harmonized Tariff Schedule of the United States (HTS) Item Count at https://www.usitc.gov/tariff_affairs/documents/2022_hts_item_count.pdf and https://www.usitc.gov/tariff_affairs/documents/2021_hts_item_count.pdf.